ELA CEO Michael Jones recently spoke at World Satellite Business Week in Paris. Below is Michael’s recap and lessons learned from a week in space!

----

Earlier this month I attended what can only be described as the very best international conference for space companies and their CEOs – World Satellite Business Week, held in Paris 11-15 September 2023.

Amongst the regalia and decadence that comes with a conference like this held in Paris – the ceilings in the venue alone were worth writing home about – were key take aways that were learned across the week, not only in the presentation/panels, but also in the 1:1 discussions during networking, and serendipitous meetings on the side lines of panel sessions.

I was honoured to be part of the Access to Space for SmallSat panel on the Wednesday. A notable theme was aligned to the expected continuation of the growth in the small and medium satellite market with another 20-30,000 satellites expected in the next 8-10 years, and the general growth/increase in the size and weight of SmallSats. What was previously averaging around the 50-200kg average mark is now clearly increasing up to 400-600kgs range. This increase in SmallSat size was seen as a result of several factors: reduction in CubeSat and other smaller satellites, multi-sensor EO and proliferation of large constellations of “small comms” and internet constellations.

Overall, this could lead to an adjustment in demand for new space small launchers. The 500-1,500kg payload capacity seems to be the “trending” sweet spot. What will this mean for launchers with <500kg payload capacity? The expected launch of several new small launchers in 2024 will soon tell us, is my guess.

ELA Group CEO and Chairman Michael Jones and Founder, Chairman and CEO of Astra Chris Kemp

Other key themes were:

Launch Capacity. Growing concerns over launch backlog and growing demand for launch. A good situation for the new launchers coming on line soon. This concern may also be a contributor to growing satellite size and capability (lower numbers and better quality satellies).

Growth in the OTV/Tug market. As a consequence of both the increased size/weight of satellites and the growing demand for precision insertion there is a clear and growing demand for OTVs and “tugs”. The operational missions of satellite retrieval, in-space servicing, repositioning and deorbiting are all contributing to this trend.

This OTV market growth is also stimulating the demand for new smaller and highly efficient (low weight/high thrust and fuel efficient in space propulsion system) space vehicle propulsion solutions.

Spectrum management. The RF spectrum is and is becoming more congested, and therefore driving/supporting a number of developments such as: on platform processing, software determined satellites in both LEO/MEO and GEO, some shift to optical coms. This will continue to be a hot topic alongside space situational awareness.

GTO/GEO making a comeback. Despite rumblings that GTO was a thing of the past, there appears to be a reversal of that thought with different configurations/replacement and new architecture of GEO supporting and driving more GEO and GSO demand.

MEO being talked about seriously. It has always been there but GEO Latency, LEO congestion etc is resulting in a definite increase MEO discussions and interest.

Launch. From a launch perspective, a key theme coming through was concern over global congestion of launch capacity – because there is a limited number of orbital spaceports globally, and an increasing number of launchers and payload customers. A situation that is only getting worse from an access-to-space perspective.

For example, Kennedy/ Cape Canaveral had 55 launches last year (a record) and are aiming to have around 98 this year. Vandenberg is a similar story with 15 launches in 2022, and up to 48 scheduled for this year. Whilst Kourou has been abnormally quiet due to circumstances with the Ariane 5 retirement, Ariane 6 delays and Vega technical delays, Arianne Space is booked out for both Ariane 6 and Vega for the foreseeable future.

The launch supply shortage is attributed to a combination of mega constellations (Starlink, One Web and Amazon Kuiper) accounting for 4-6,000 satellites being launched, as well as an increase in institutional launch primarily in the ISR/National security areas and the replacement/establishment of space infrastructure.

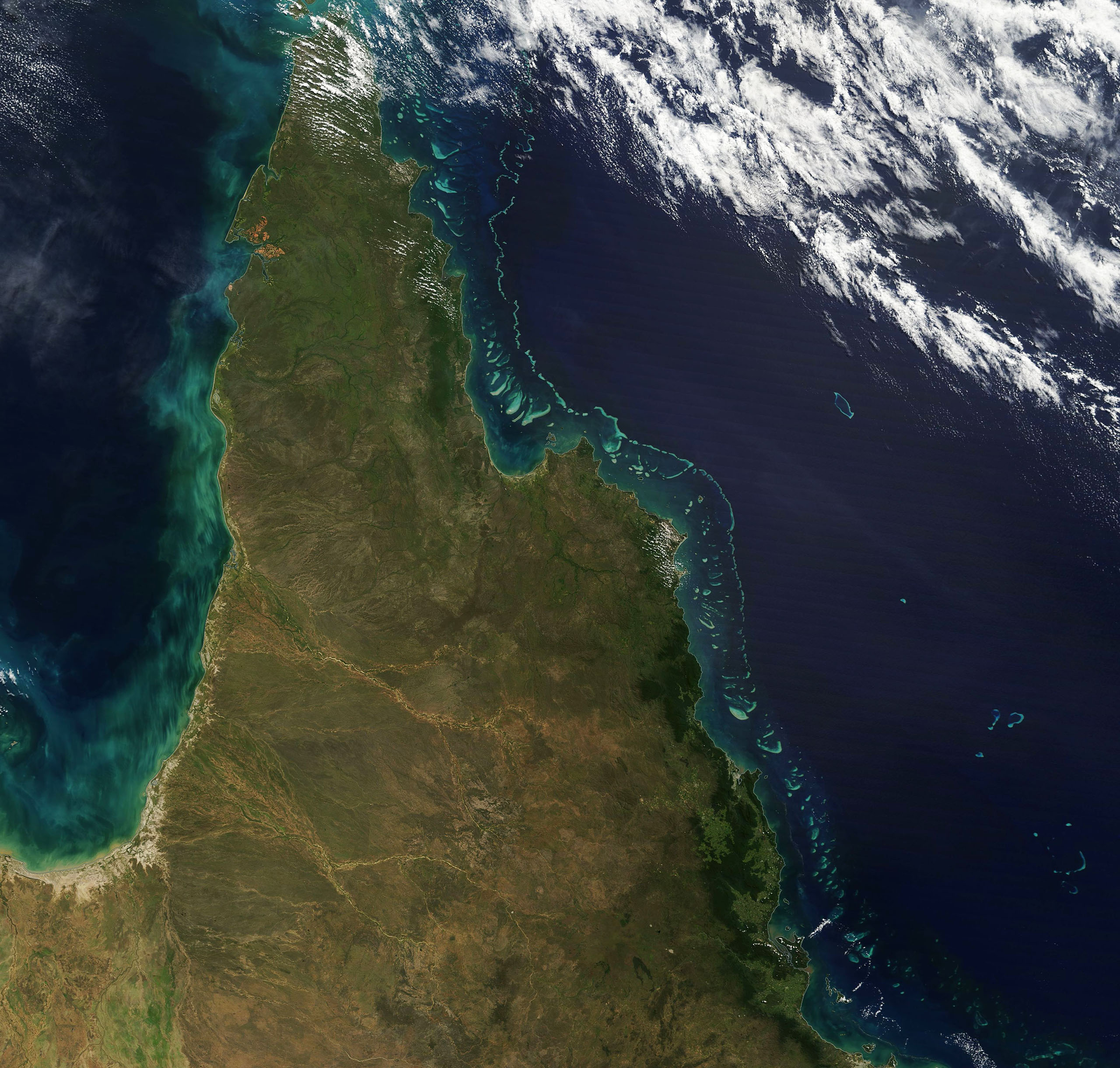

This is where Australia can come in. Offering significant orbital launch capabilities, like those provided by ELA, to “new space” smaller rocket companies and their payload customers will not only help relieve that backload, but it will also provide the precision insertion and tailored services which are so in demand right now for these smaller sized rockets – which will soon account for up to half the number of launches and over 8% of the payload delivered.

Investment in Space. Often talked about – the ‘decrease’ and quantum of Investment in space was also an eye-opening key topic of the Paris conference.

Over the past three years investment has decreased in terms of total dollars invested but the number of the deals and the quality of investable assets has increased significantly. The mega deals of 2021 skewed the data somewhat.

2021 - US$50Bn – year of the mega deals.

2022 - US$21Bn – completed deals had solid fundamentals and accepted slightly lesser return on investment

2023 – US$9bn has already been invested and is looking like an increase towards end of year – again definable return and path to profit defined the quality of deals.

2024 – expected increase to quantum of transactions expected and again a step up in quality.

2023 is being characterised by slight increase in “smaller deals of higher quality” and a trend to later stage entry with quality of revenue and clear market positioning required. Higher intertest rates and bond yields result in investors just parking money and waiting for the ‘right deal’.

Governmental budgets. This also inevitably became a topic of conversation with modest increases in the US to US$26bn. Likewise ESA’s budgets of €7.1Bn has been more targeted and aggressively deployed with:

$1.2Bn in Navigation and positioning satellite/technology

$1.8bn in Earth Observation

$0.6Bn in Telecom

The reduction in Australian budget to circa. A$405m puts it in the third quartile globally and is a clear message to industry here: do it on your own and be competitive from the outset.

Understanding the international perspective and market trends is important for Australian space companies to ensure we are operating and existing as part of the global space ecosystem and to make sure we aren’t left behind. We need to predict and intercept the market and provide the services where and when they are required. We can’t expect or rely on government support.

Each time I travel, I make sure to fully debrief the team upon my return. Collectively, we take these learnings and integrate them into our approach to market, ensuring that we are offering a world class, demand-driven and relevant service to our international customers.

To stay up to date with updates from ELA follow us on LinkedIn or subscribe to our newsletter